What is the Disaster Risk Insurance Platform?

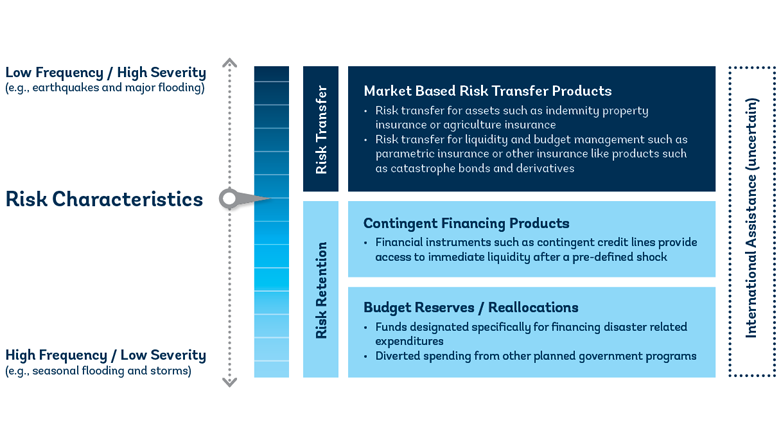

The World Bank Treasury Disaster Risk Insurance Platform provides clients with advisory support and risk transfer solutions (insurance, derivatives, and catastrophe bonds) offering financial protection against a wide range of shocks: droughts, floods, tropical cyclone, earthquake, tsunami, pandemic and other types of insurable perils.

How does the Disaster Risk Insurance Platform work?

The Platform provides:

- Advisory services to build client’s capacity to understand risk transfer products and options, and transfer risk to international markets; and

- Executions services to transfer the client’s risk to insurance and capital markets.

Implementing insurance, derivative, and catastrophe bond programs can present serious challenges due to the complexity of the underlying statistical models, legal documentation, procurement constraints, and market dynamics and the Platform helps clients overcome these barriers.

Advisory Services

Advisory services provided by the World Bank Treasury help clients build capacity for implementing disaster risk financing solutions. Services are often provided in collaboration with the Disaster Risk Financing and Insurance Program (Finance Competitiveness and Innovation Global Practice), Disaster Risk Management (Social, Urban, Rural and Resilience Global Practice), and other Bank experts.

Advisory services are provided by both in-house experts and external service providers, such as catastrophe risk modeling agencies, legal counsel, and structuring agents. Services can be financed through Trust Funds, Reimbursable Advisory Service (RAS), lending operations, or the Government’s own funds, among other sources.

The World Bank helps clients understand different risk transfer options and engage with relevant counterparties:

- Training on risk transfer options including traditional insurance, derivatives, and catastrophe bonds

- Evaluating risk transfer options relative to a client’s limitations or preference from a legal, regulatory or budget perspective

- Procuring catastrophe risk modeling services to develop amongst others a (i) credible and transparent view of the underlying risk, (ii) sample risk transfer structures, and (iii) evaluation of the costs of risk transfer products

- Procuring external service providers to support the structuring of risk transfer execution

- Preparing and supporting clients with the key decisions regarding the legal, technical and financial requirements of a transaction

Execution services

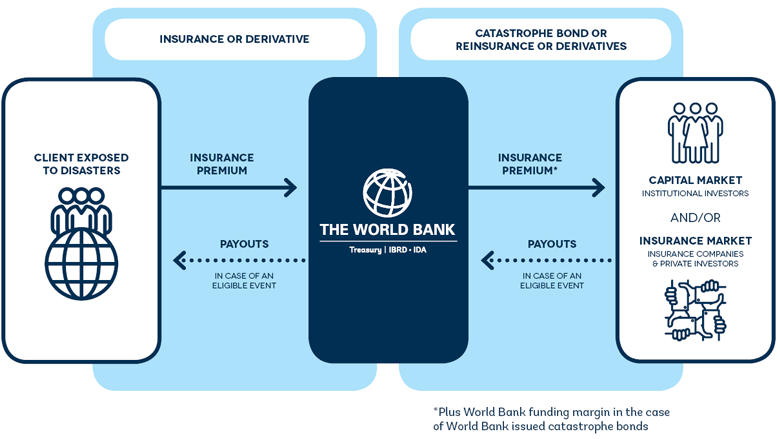

The World Bank Treasury intermediates market-based insurance solutions for clients. These Solutions provideclients with liquidity after a disaster event with pre-defined characteristics. without increasing a client’s debt. A client’s only counterparty is the World Bank, which stands between clients and the markets. Any credit risk from market counterparties is retained and managed by the World Bank.

The World Bank enters into an insurance or derivative agreement with clients, providing financial protection that fits within their legal and regulatory framework. The agreement guarantees clients a payout upon the occurrence of a pre-defined event. In exchange, clients agree to make insurance premium payments to the World Bank.

The World Bank simultaneously transfers clients’ risk to insurance and capital markets, through reinsurance, derivative, or catastrophe bond solutions. The World Bank agrees to make premium payments to the insurance or capital market in line with the insurance premium payments under the client’s contract. Upon the occurrence of a pre-defined event, the World Bank receives payouts from market counterparties in line with those due to the client under the client’s contract.

The World Bank Treasury handles, in consultation with the client, the selection, structuring, and all documentation issues with the markets.

Related

Feature Story | The Philippines: Transferring the Cost of Severe Natural Disasters to Capital Markets